Investing in gold has become an increasingly common strategy for individuals seeking to diversify their retirement portfolios and protect their wealth in opposition to economic uncertainty. One of the simplest ways to spend money on gold is thru Individual Retirement Accounts (IRAs), which offer tax advantages and a wide range of investment options. This report provides an in-depth evaluation of IRA gold investing, together with its advantages, forms of gold IRAs, rules, dangers, and techniques for successful funding.

Understanding Gold IRAs

A Gold IRA is a specialized type of self-directed Individual Retirement Account that allows buyers to hold bodily gold and other treasured metals as a part of their retirement portfolio. In contrast to traditional IRAs, which typically hold paper belongings like stocks and bonds, Gold IRAs provide the opportunity to spend money on tangible property, which may function a hedge in opposition to inflation and economic downturns.

Types of Gold IRAs

There are two main sorts of Gold IRAs: Conventional Gold IRAs and Roth Gold IRAs.

- Traditional Gold IRAs: Contributions to a traditional Gold IRA are made with pre-tax dollars, meaning that taxes are deferred till withdrawals are made during retirement. The sort of account is useful for individuals who anticipate to be in a decrease tax bracket during retirement.

- Roth Gold IRAs: Contributions to a Roth Gold IRA are made with after-tax dollars, permitting for tax-free withdrawals throughout retirement, offered certain circumstances are met. This feature is advantageous for many who anticipate being in a higher tax bracket sooner or later.

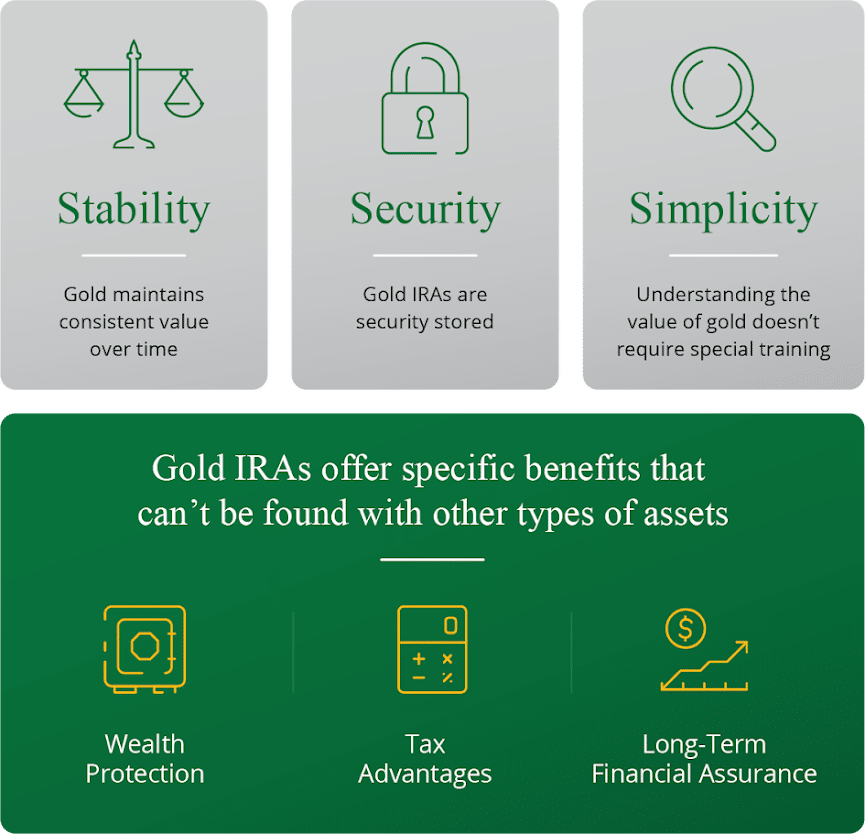

Advantages of Investing in Gold via IRAs

Investing in gold via an IRA affords a number of advantages:

- Diversification: Gold is commonly thought-about a protected-haven asset that may present stability throughout intervals of market volatility. In the event you loved this short article as well as you desire to receive more info about trusted best companies for retirement ira investments for precious metals iras (https://mypropertybasket.com/author/wqvthanh153422) i implore you to pay a visit to our web-page. Together with gold in an IRA can help diversify an funding portfolio and reduce general risk.

- Inflation Hedge: Gold has traditionally maintained its value throughout inflationary durations. As the buying power of fiat currencies declines, gold usually appreciates, making it a reliable retailer of worth.

- Tax Advantages: Gold IRAs present tax-deferred growth, permitting buyers to profit from potential appreciation without speedy tax consequences. This will result in vital savings over time.

- Protection Towards Financial Uncertainty: In occasions of financial instability or geopolitical tensions, traders typically flock to gold as a safe-haven asset. Holding gold in an IRA can present peace of thoughts throughout turbulent instances.

Regulations Governing Gold IRAs

Investing in gold through an IRA is topic to particular regulations established by the interior Income Service (IRS). Key regulations include:

- Eligible Metals: The IRS allows only certain forms of gold and treasured metals to be held in an IRA. Eligible investments include gold bullion coins, bars, and sure gold American Eagle coins, provided they meet minimal purity standards (at the least 99.5% for gold).

- Custodians: Gold IRAs must be held by a professional custodian or trustee. These custodians are responsible for managing the account, ensuring compliance with IRS laws, and storing the physical gold in secure amenities.

- Storage Requirements: The IRS mandates that physical gold held in an IRA have to be stored in an authorised depository. Buyers cannot take possession of the gold till they attain retirement age, at which point they can choose to sell the gold or take bodily delivery.

Dangers Associated with Gold IRAs

While investing in gold by an IRA has its advantages, it additionally comes with risks that buyers ought to consider:

- Market Volatility: The worth of gold may be extremely risky, influenced by various components resembling financial situations, interest rates, and geopolitical events. Buyers should be prepared for fluctuations in worth.

- Liquidity Issues: Unlike stocks and bonds, which could be simply traded on exchanges, selling bodily gold could take longer and could incur extra prices. This may occasionally affect an investor's ability to access funds rapidly.

- Storage Fees: Gold IRAs usually come with storage charges charged by custodians for the protected protecting of the bodily property. These charges can range considerably based mostly on the depository and the amount of gold held.

- Potential Scams: The gold funding market has seen its share of scams and fraudulent schemes. Traders ought to conduct thorough due diligence when selecting a custodian or supplier to avoid falling sufferer to unscrupulous practices.

Methods for Successful Gold IRA Investing

To maximise the advantages of gold investing by way of an IRA, consider the following strategies:

- Research and Choose a good Custodian: It's essential to pick a custodian with a stable reputation and expertise in handling gold IRAs. Look for customer opinions, regulatory compliance, and transparent payment constructions.

- Diversify Within the Gold Sector: Traders could need to diversify their gold holdings by together with completely different types of gold, corresponding to coins, bars, and even gold mining stocks. This can assist mitigate dangers associated with price fluctuations.

- Stay Informed About Market Developments: Keeping abreast of financial indicators, interest charges, and geopolitical occasions can help buyers make knowledgeable decisions about when to purchase or promote gold.

- Consider Long-Time period Holding: Gold is often considered as a long-time period investment. Investors needs to be prepared to hold their gold IRA for several years to totally realize its potential benefits.

- Seek the advice of with Monetary Advisors: Engaging with monetary advisors who focus on treasured metallic investments can provide useful insights and help traders align their gold IRA technique with their overall retirement goals.

Conclusion

Investing in gold via an IRA is usually a strategic solution to diversify a retirement portfolio, hedge against inflation, and protect wealth during financial uncertainty. Whereas there are risks and rules to contemplate, the potential benefits make gold IRAs an appealing option for a lot of traders. By conducting thorough analysis, selecting respected custodians, and using sound investment methods, individuals can successfully navigate the world of gold investing and enhance their retirement savings.