In recent times, the concept of investing in a Gold Individual Retirement Account (IRA) has gained vital traction among traders searching for to diversify their retirement portfolios. Because the economy experiences fluctuations and uncertainties, individuals are increasingly searching for stable and tangible belongings to safeguard their monetary future. This text delves into the observational trends and advantages associated with shopping for a Gold IRA, shedding light on why this funding choice has change into a preferred choice among retirees and those seeking to safe their wealth.

The Rise of Gold IRAs

The allure of gold as a protected haven asset is just not a new phenomenon. Traditionally, gold has been viewed as a reliable store of worth, especially throughout times of financial instability. The global financial disaster of 2008 and the recent COVID-19 pandemic have reignited curiosity in gold as a protecting measure in opposition to inflation and market volatility. Observational research counsel that traders are increasingly turning to Gold IRAs as a approach to hedge towards potential losses in traditional retirement accounts.

The growth of Gold IRAs may be attributed to several components. Firstly, the growing awareness of the benefits of diversification has prompted investors to explore different belongings. Secondly, the rising prices of gold lately have made it a beautiful investment possibility. In line with market information, gold costs have proven a gentle upward trend, additional encouraging people to think about gold as a viable retirement investment.

Understanding Gold IRAs

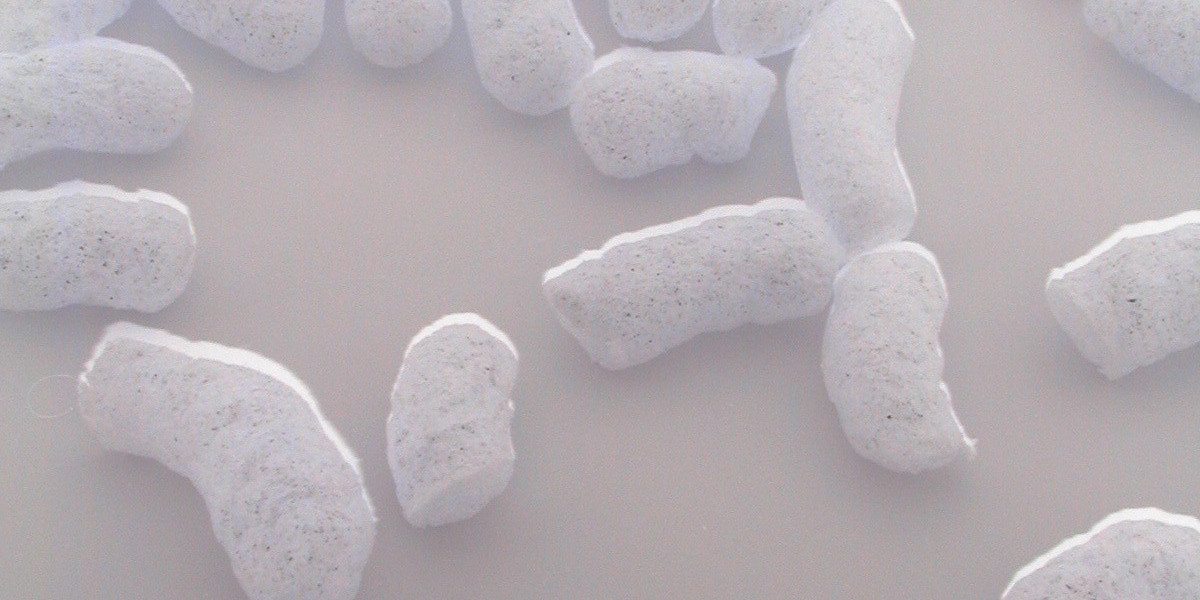

A Gold IRA is a type of self-directed individual retirement account that permits traders to hold physical gold and other treasured metals as a part of their retirement portfolio. Unlike conventional IRAs, which sometimes consist of stocks, bonds, and mutual funds, Gold IRAs provide the chance to spend money on tangible belongings. This distinctive feature is particularly interesting to those who desire to have direct control over their investments.

When setting up a Gold IRA, buyers should choose a custodian who specializes in treasured metals. These custodians are answerable for managing the account and making certain compliance with IRS regulations. Moreover, buyers can choose from a range of eligible gold products, including coins, bars, and bullion. The IRS has specific tips concerning the purity and types of gold that may be included in a Gold IRA, making it important for traders to conduct thorough analysis earlier than making their purchases.

Benefits of Investing in Gold IRAs

1. Protection Against Inflation

One of the primary advantages of investing in a Gold IRA is its capacity to act as a hedge against inflation. As the cost of residing rises, the buying energy of fiat foreign money diminishes. Gold, on the other hand, has historically maintained its worth over time. If you cherished this article and you would like to obtain more info relating to recommended options for precious metals ira firms for retirement gold-backed ira rollover (https://pakrozgaar.com/) generously visit our internet site. By together with gold of their retirement portfolios, investors can protect their financial savings from the erosive results of inflation.

2. Portfolio Diversification

Diversification is a basic precept of sound investing. By including gold to a retirement portfolio, traders can cut back their general risk exposure. Gold often behaves in a different way than traditional property such as stocks and bonds, making it an efficient tool for balancing risk. Observational knowledge indicates that throughout periods of market downturns, gold prices tend to rise, offering a buffer for buyers.

3. Tangible Asset

Not like stocks or bonds, gold is a physical asset that buyers can hold of their palms. This tangibility gives a way of safety for a lot of people, particularly throughout times of financial uncertainty. Understanding that a portion of their retirement savings is saved in a bodily kind can supply peace of thoughts to traders who're cautious of the volatility in monetary markets.

4. Potential for Lengthy-Time period Development

While gold is usually considered as a stable asset, it also has the potential for long-term appreciation. Historic data exhibits that gold costs have elevated significantly over the past few a long time. Buyers who choose to buy gold for his or her IRAs might benefit from capital appreciation, especially if they hold the asset for an prolonged period.

Observational Trends in Gold IRA Purchases

As the recognition of Gold IRAs continues to rise, several observable traits have emerged among traders.

1. Increased Participation by Youthful Buyers

Traditionally, gold investments were extra widespread among older buyers nearing retirement. Nonetheless, latest observations point out that youthful investors are becoming more and more concerned about Gold IRAs. This shift could be attributed to a growing consciousness of financial uncertainties and a desire for financial independence. Youthful individuals are extra inclined to seek different investment options that present each security and progress potential.

2. Rise of Online Gold IRA Providers

The digital age has remodeled the way in which investors strategy retirement accounts, including Gold IRAs. Observational data reveals a surge in online gold IRA providers, making it simpler for people to arrange and manage their accounts. These platforms typically offer academic resources, permitting buyers to make informed choices about their gold purchases.

3. Emphasis on Ethical and Sustainable Investing

One other trend noticed in the Gold IRA market is the increasing emphasis on ethical and sustainable investing. Traders have gotten more conscious of the environmental and social impacts of their investments. Because of this, many gold IRA providers at the moment are providing ethically sourced gold options, interesting to socially accountable traders who want to align their financial goals with their values.

Conclusion

In conclusion, the development of shopping for Gold IRAs will not be merely a passing fad; it reflects a broader shift in investor sentiment towards tangible belongings amid economic uncertainties. The benefits of investing in gold, together with protection against inflation, portfolio diversification, and the attraction of a tangible asset, have made Gold IRAs a beautiful option for a variety of investors. As younger generations enter the funding landscape and the digital market continues to evolve, it is likely that the recognition of Gold IRAs will persist. For those contemplating their retirement strategies, the option to invest in gold might present a invaluable opportunity to secure their financial future in an unpredictable world.